Are you looking to open a bKash merchant account? If so, then you must know in detail about the rules for bKash merchant account open and the advantages and disadvantages of this bKash merchant account.

If you read today’s post to the end, you will be able to learn the details about this bKash Merchant Account registration, including the bKash Merchant Account Cash Out Charge.

Remember, we will teach you how to register a bKash Merchant Account so that you can open it while sitting at home.

This way, you can easily apply to open a bKash Merchant Account at home, and your bKash Merchant Account will be ready instantly. So now, let’s know the details about the bKash Merchant Account.

What is a bKash Merchant Account?

There are different types of bKash account services. One of them is called a bKash Merchant Account. Businesspeople mainly need this merchant account.

If you want to accept payments from your business through bKash, you need a bKash Merchant Account.

This bKash Merchant Account will significantly increase people’s credibility towards your business. All bKash customers in Bangladesh can easily send money to your merchant account and receive their services.

So, a bKash account used for business is a bKash Merchant Account.

What is required to open a bKash Merchant Account?

Since a bKash Merchant Account is related to business, you must submit several documents and information needed to the bKash authorities.

- First, you need a shop and a valid trade license in the actual name of that shop.

- You must have a valid Bangladeshi National Identity Card.

- You must have a valid SIM card with your national identity card.

- A recent passport-size photograph is required to open this bKash Merchant Account.

If you have all the above documents and papers, you can easily apply for a bKash Merchant account. If there are no problems, you will quickly get a bKash Merchant account.

BKash merchant account opening rules

So, friends, if you want to open a bKash merchant account properly from home, you must know the rules for opening one from start to finish.

Here, you will be given sufficient information about the documents required to open a bKash merchant account.

Steps for Bkash Merchant Account Registration

Step 1: First, you must collect all the above-mentioned documents and your photo and keep them with you.

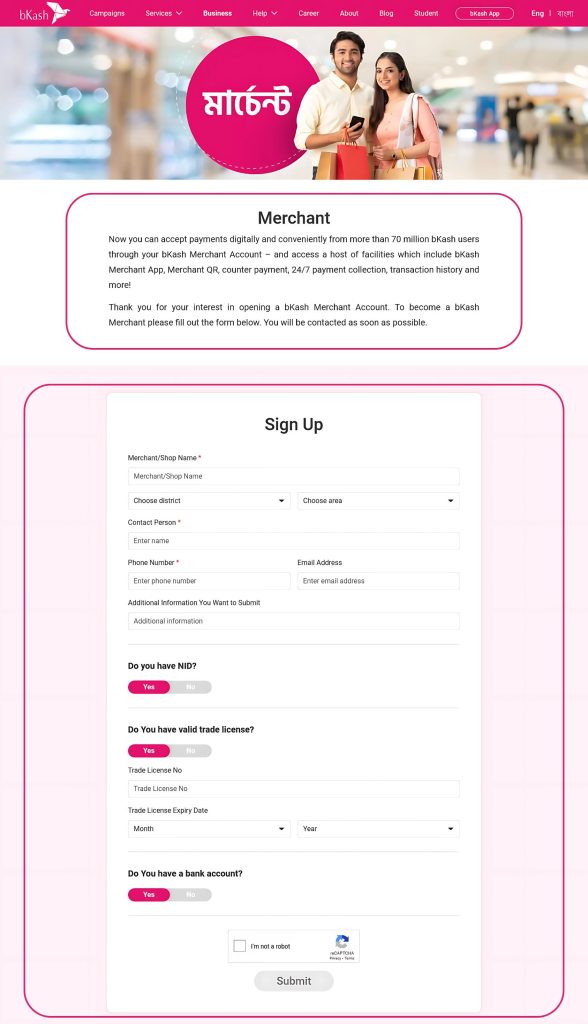

Step 2: We will give you a bKash website address, which you must enter. After entering this address, you will be asked for all the documents and information.

Bkash Merchant official website address.

- First, you will be asked to provide the name of your shop. Please put your correct shop name in the first box.

- Please select your area in the following box. A person from the bKash authority will verify your identity at the address you provide.

- Then, you will correctly enter the number, email address, and additional information you want to submit in the following box.

- In the next box, you will be asked to select whether you have a national identity card. If you do, please say yes.

- In the next box, you will be asked whether you have a valid trade license. If you do, give yes. Correctly put the trade license number and expiration date in the valid trade license option.

- After going through all the above steps and boxes, you will be asked whether you have a bank account. If you do, give yes.

- Coming to the last option, you will see another box called “I am not a robot.” If you press this box, it will be ticked, and all your steps will be completed.

Press the submit button once you have completed the above steps and filled out all the boxes. Your information will reach the bKash authorities.

After this, within a few days, bKash people will contact you and visit your store. They will come to the store and may ask for more documents from you. If you provide them with the information, they will activate your bKash merchant account later.

Learn more: How to get Bkash loan

Bkash Merchant Account – Advantages and Disadvantages

Now, we will discuss the advantages and disadvantages of the Bkash Merchant Account with the readers. There are no disadvantages to this Bkash account, but you will get many benefits. So, let us learn about these things step by step.

Benefits of bKash Merchant Account

If you want to run a business with a personal bKash account, you will face many problems. But if you run your business activities using a bKash merchant account, you will get many benefits, as described below.

- If you have a bKash merchant account, you will get a bKash QR code that customers can scan to pay you quickly.

- You will receive a separate application for bKash merchant, from which you can perform all your merchant account activities.

- Through the bKash merchant account, you can see how much money your business has received each month, how much money has been refunded, and many other types of information.

- Customers who send money to your bKash merchant account will not be charged extra fees.

- Customers can send money to your bKash merchant account by dialling *247#, and you can also manage your account by dialling this same code.

- If you have a merchant account, you will get a free automatic payment gateway from bKash, through which customers can easily make automatic payments.

- You will get a separate bKash business dashboard to manage your bKash merchant account and other extra features.

- You can also cash out from a personal bKash account, recharge mobile phones, and pay various types of bills in a bKash Merchant Account.

- A personal account has charges and various limitations. Still, your bKash Merchant Account has much higher limitations, meaning you can transact much more money daily and monthly.

- If a customer sends money to your account, you can cancel that transaction, and the funds will be returned to the customer.

- There is a 24/7 support system from the bKash authorities for bKash merchant account users.

- When you first open a bKash Merchant Account, you can cash out up to a maximum of five thousand taka for the first three months using this account for free.

- You can cash out through bKash agents and other channels, such as a personal account.

Disadvantages of bKash Merchant Account

You will not find any difficulty here once you have successfully linked your bKash Merchant Account to your business. Even then, you can talk to the bKash authorities if you find any difficulty. However, I have discussed all the problems that I found below.

- A 5 taka fee is deducted whenever you send money from your bKash Merchant Account to your Account.

- You can make a maximum transaction of up to 30 thousand taka from your bKash Merchant Account.

- You will always need the internet to maximize the benefits of your bKash Merchant Account and manage it well.

- Every time you make a transaction from your bKash Merchant Account, a certain amount of money is deducted from your bKash account.

Bkash Merchant Account Cash Out Charge

Many who use this Bkash Merchant Account have questions about how much this Bkash Merchant Account Cash Out Charge is. So we will now explain this Bkash Merchant Account Cash Out Charge to you in detail.

Remember, when you open a new bKash merchant account, you can cash out up to 5,000 taka utterly free within the first three months.

If you cash out from your bKash merchant account, you will be charged a 1.49% fee. If you cash out 100 taka, 1.49 taka will be charged in cricket.

This 1.49 per cent cash-out fee will be deducted only when you cash out from your bKash merchant account at a bKash agent and a specific ATM booth.

It is worth mentioning here that you can cash out a minimum of one taka from a bKash agent, a minimum of two thousand taka from an ATM, and a minimum of 2500 taka from BRAC Bank.

Learn more: Bkash Agent Business Profit

bKash Merchant Account Send Money Charge

We have explained the bKash Merchant Account Cash Out Charge above; now, we will explain the bKash Merchant Account Send Money Charge in detail.

If you want to send money from your bKash account to any personal bKash account, you will be charged a fee of 5 taka each time you send money. You can send money to this bKash account for at least 1 taka.

Again, if you want to pay from one merchant account to another, a charge of 0.20% will be deducted here.

Bkash Merchant Account Limit

You can also conduct business with a Bkash Merchant Account, but there is a limit to this Account.

- Through this Bkash Merchant Account, you can accept up to 30 thousand taka per transaction from your general customers.

- Again, general customers can transact a maximum of thirty thousand taka daily and a maximum of five lakh taka monthly.

bKash Merchant Account Send Money Limit

If a customer wants to send money to bKash Merchant, he can send a maximum of 10 thousand taka per transaction. Again, in this case, you can send a maximum of 10 thousand taka daily.

A maximum of one lakh taka can be sent from a bKash Personal Account to a bKash Merchant Account in a month.

bKash Merchant Account Cash Out Limit

Since you will be cashing out from the bKash Merchant Account most of the time, you must know about the bKash Merchant Account Cash Out Limit well.

A maximum of 20 thousand taka can be cashed out from a bKash Merchant Account per transaction.

Again, a maximum of 20 thousand taka can be cashed out daily. However, you can cash out up to three lakh taka from a merchant to an agent account in a month.

bKash Merchant Commission

You will not get any extra commission as a bKash merchant account user. This is because bKash has given you this merchant account, and you can get different benefits from it.

But yes, if you want to earn commissions from a bKash account, you must open a bKash agent account and complete various transactions using that account.

Our last words

Today’s post provided complete information about the bKash Merchant Account and discussed what people search online for.

If you want to know more about the bKash Merchant Account after reading this post to the end, ask us in the comments.

Visit our Faizul Softonic website regularly to get more updates on such topics. Thank you..

Learn more: Mobile recharge business in Bangladesh